Your basket is currently empty!

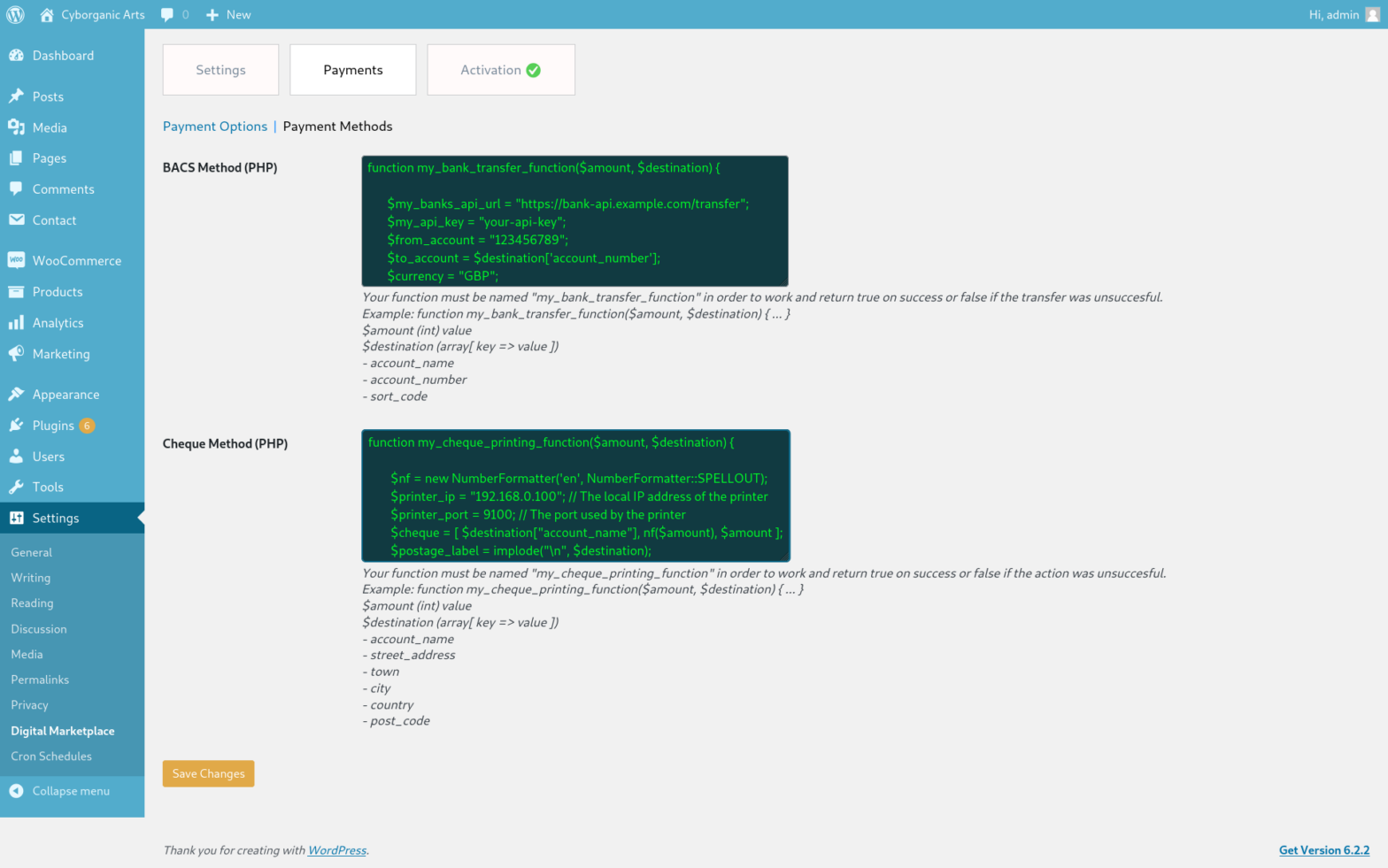

This is an example of how you might structure a bank transfer request using PHP and cURL, in the Digital Asset Marketplace extension for WooCommerce. This function will be called each time a user requests to withdraw funds, following integrated balance checks against the clients virtual ledger.

In this example, let’s assume you are using the cURL library to make a POST request to your banks API to facilitate user withdrawals. Replace the placeholders prepended with “your_” with the actual values provided by your bank account and adjust the code according to the API‘s documentation and requirements.

function my_bank_transfer_function($amount, $destination) {

// Get current user ID

$user = wp_get_current_user();

// Replace these values with actual API endpoint and credentials

$apiEndpoint = 'https://your_api.examplebank.com/transfer';

$apiKey = 'your_api_key';

$apiSecret = 'your_api_secret';

For security purposes highlighted variables should be set using environment variables in production! Learn more about setting environment variables in WordPress.

// Prepare transfer data

$transferData = [

'from_account' => 'your_source_account_number',

'to_name' => $destination['account_name']

'to_account' => $destination['account_number'],

'to_sort_code' => $destination['sort_code'],

'amount' => $amount,

'reference' => 'Withdrawal by user #'.$user

];

// Generate a signature (you might need to follow your API's authentication process)

$signature = hash_hmac('sha256', json_encode($transferData), $apiSecret);

// Prepare request headers

$headers = [

'Content-Type: application/json',

'Authorization: Bearer ' . $apiKey,

'X-Signature: ' . $signature

];

// Initialize cURL session

$ch = curl_init($apiEndpoint);

// Set cURL options

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

curl_setopt($ch, CURLOPT_POST, true);

curl_setopt($ch, CURLOPT_POSTFIELDS, json_encode($transferData));

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

// Execute cURL request

$response = curl_exec($ch);

// Check for errors and handle response

if ($response === false) {

error_log( "cURL Error: " . curl_error($ch) );

} else {

$responseData = json_decode($response, true);

if ($responseData['status'] === true) {

//Transfer successful

return true;

} else {

//Transfer failed

return false;

}

}

// Close cURL session

curl_close($ch);

}

Please remember to thoroughly test and adapt this code to fit your banks API requirements. Additionally, implementation of best security practices such as TLS is paramount to ensure the safety and reliability of financial transactions.

- Accuracy and Security: While the code provided is a basic example, financial transactions involve sensitive information and security considerations. It’s crucial to thoroughly review and potentially enhance the security measures, error handling, and authentication methods to match the requirements of the API you are integrating with.

- API Documentation: Always consult the official documentation of the remote API you’re working with. Your bank will have specific guidelines, best practices, and security recommendations for integrating their services.

- Testing: Before deploying any code related to financial transactions on a live website, thoroughly test it in a controlled environment to ensure its functionality and security.

- Legal and Compliance: Depending on your jurisdiction and the nature of your website, there might be legal and compliance requirements related to financial transactions. Make sure you’re aware of and compliant with these regulations.

Remember, financial transactions involve real money and personal data, so prioritizing security and accuracy is paramount.